Global Ro-Ro Shipping Sets Strict Vehicle Size and Weight Limits

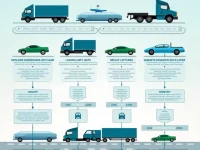

This article provides a detailed overview of the requirements and cost structure for international freight vehicle transportation, emphasizing the understanding of vehicle size and loading limits, as well as ensuring that transport vehicles are in good condition. For clients, knowing this information will improve transportation efficiency and reduce unnecessary losses and costs. It is recommended to confirm vehicle specifications and related requirements with agents before transportation to ensure a smooth pickup.